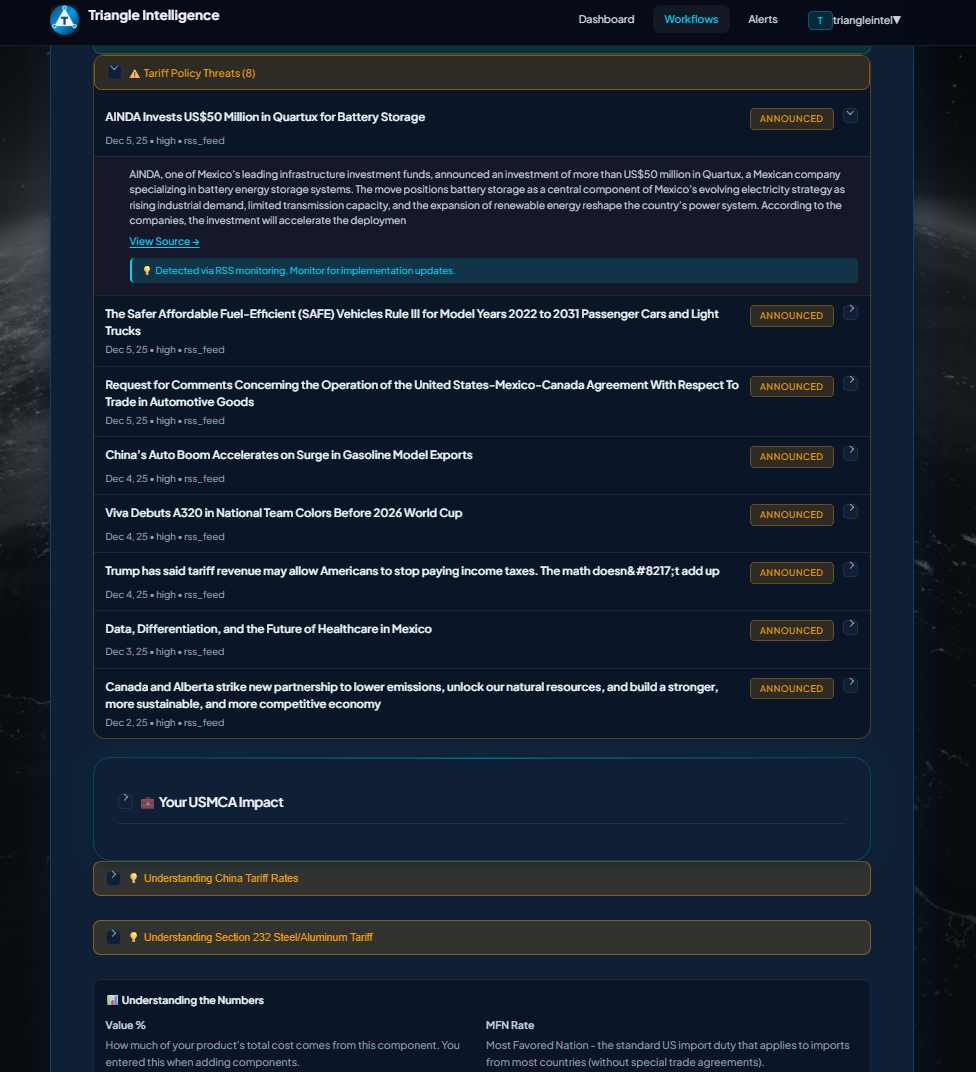

Tariff Policy Alerts

For Your Products

We monitor Section 301, 232, and USMCA daily. Get alerts when changes affect you.

Who Needs Ongoing Alerts?

Importers

Avoid overpaying when tariffs increase. Get notified 30 days before Section 301 or Section 232 rate changes affect your products - giving you time to adjust pricing or find alternative suppliers.

Exporters

Notify your B2B buyers when policy changes affect their duty-free status. Maintain competitive advantage by proactively addressing tariff impacts before your buyers discover them.

Manufacturers

Know when policy changes could invalidate certificates you provided to distributors. Get alerts when USMCA thresholds or origin rules change, so you can update documentation before customs issues arise.

Why Ongoing Monitoring Matters

You generated your certificate. Great. But tariff policies don't stay frozen.

Section 301 Changes Weekly

China tariffs get adjusted with 30-day notice. Miss the announcement? You're paying more than necessary.

USMCA Rules Update

Regional content thresholds and origin rules can change. Your qualifying certificate might not qualify next year.

Section 232 Surprises

Steel, aluminum, and strategic goods face sudden tariff adjustments with national security justifications.

You Can't Monitor Everything

Federal Register, USTR announcements, CBP rulings - impossible to track alone while running your business.

Most importers, exporters, and manufacturers find out about tariff changes AFTER they've already paid higher rates for 2-3 months. That's money you can't get back.

What We Monitor For You

Component-Level Alerts

- ✓ Specific to YOUR HS codes and origin countries

- ✓ Section 301 rate adjustments (China tariffs)

- ✓ Section 232 national security tariffs

- ✓ USMCA threshold changes

Live Policy Alerts (Section 301, 232)

- ✓ Country-wide tariff changes (e.g., all China imports)

- ✓ Industry-specific policy shifts

- ✓ Trade agreement updates (USMCA renegotiation)

- ✓ Reciprocal tariff announcements

What We're Monitoring Right Now

Forward-looking intelligence on 2026 policy changes - not just current rates

📅 Stream 1: USMCA Renegotiation Watch

Timeline: January-March 2026

What to Watch: Cumulation rule changes, Chinese PCBA component restrictions

Monitoring: Weekly (USTR, Mexico Economy Ministry, Canadian Global Affairs)

Why It Matters: Could force PCBA sourcing changes within 90 days

📊 Stream 2: Section 301 Tariff Rate Cycles

Timeline: March-April rate reviews, April-May announcements

What to Watch: HS 8534.00.00 (PCBA) rate changes (currently 15-25%)

Monitoring: Daily (USTR.gov tracker, trade press)

Why It Matters: 5-10% rate increase = significant cost impact

💰 Impact Example: 5-10% rate increase on $4M China imports = $200k-$400k annual cost increase

🔍 Stream 3: Mexican Labor & Aluminum Sourcing

Timeline: Quarterly deep dives (ongoing)

What to Watch: Labor verification rules, Section 232 aluminum sourcing

Monitoring: Quarterly (Diario Oficial, aluminum industry reports)

Why It Matters: Tightening could force supplier restructuring

⚠️ Critical Intelligence Gaps We Identify

Gap 1: What specific HS codes might be affected by cumulation rule changes?

Gap 2: Are your Mexican suppliers compliant with tightening labor verification?

These gaps should be addressed through supplier conversations in Q4 2025 - before the 2026 changes hit.

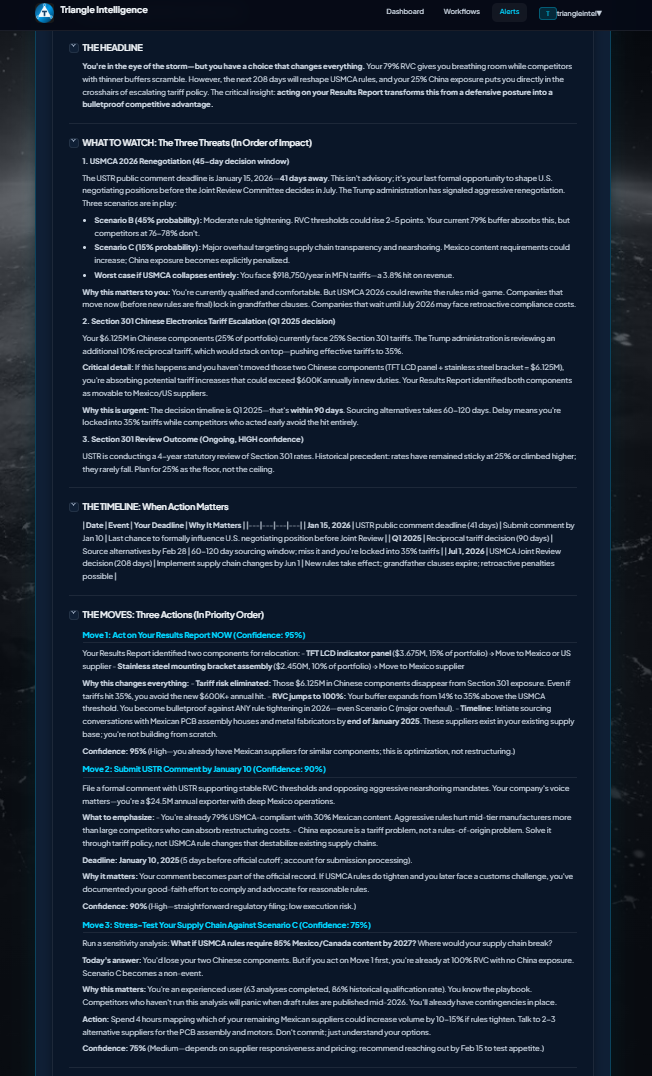

Strategic Portfolio Reports

Alerts tell you WHAT changed. Reports tell you what to DO about it.

Bottom Line Impact Analysis

- ✓ Which components are affected by new policies

- ✓ Financial impact on your specific supply chain

- ✓ Timeline of when changes take effect

- ✓ Confidence scoring on each recommendation

Strategic Considerations

- ✓ Supplier diversification opportunities

- ✓ Mexico nearshoring ROI calculations

- ✓ CBP binding ruling guidance (Form 29)

- ✓ 3-phase action plan with timeline

These aren't generic reports. Whether you're importing, exporting, or manufacturing - every briefing is specific to your components, your volumes, and the exact policies affecting you.

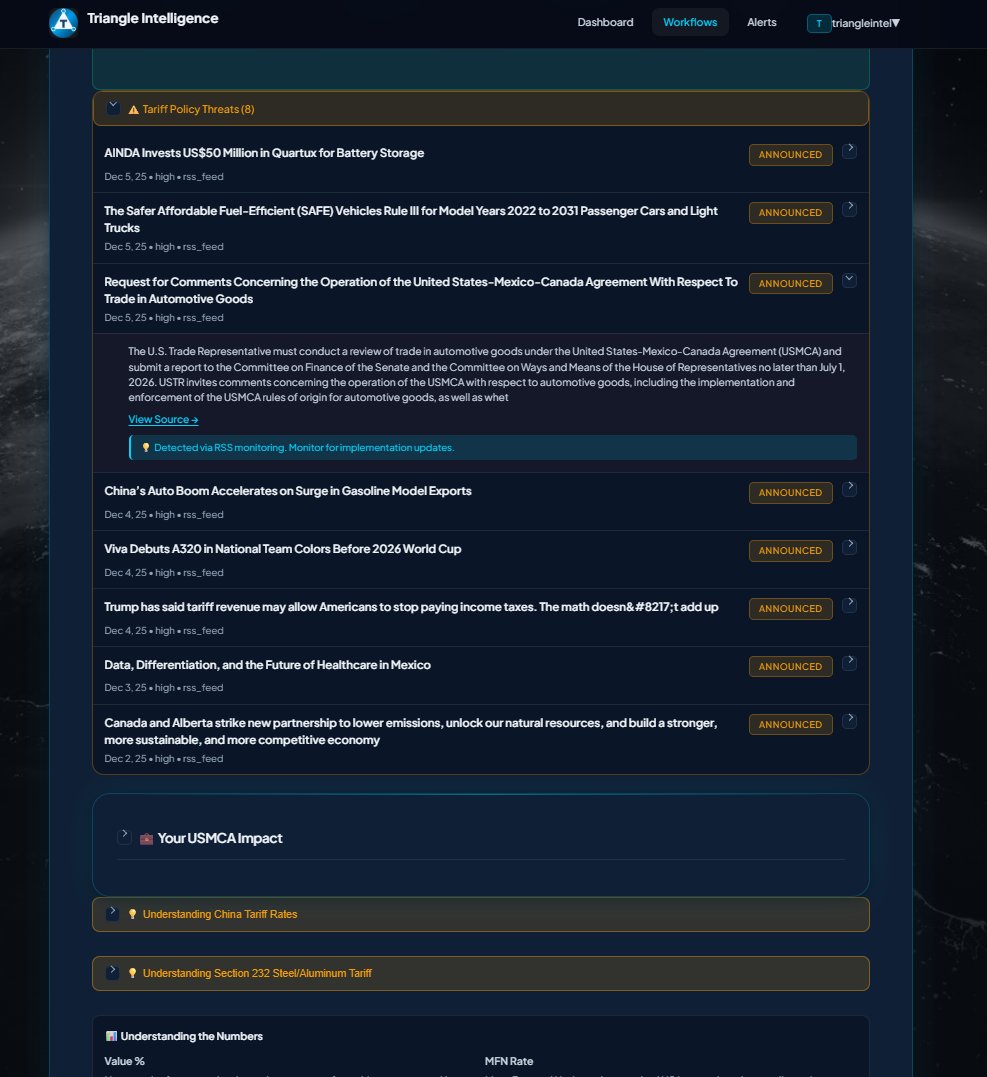

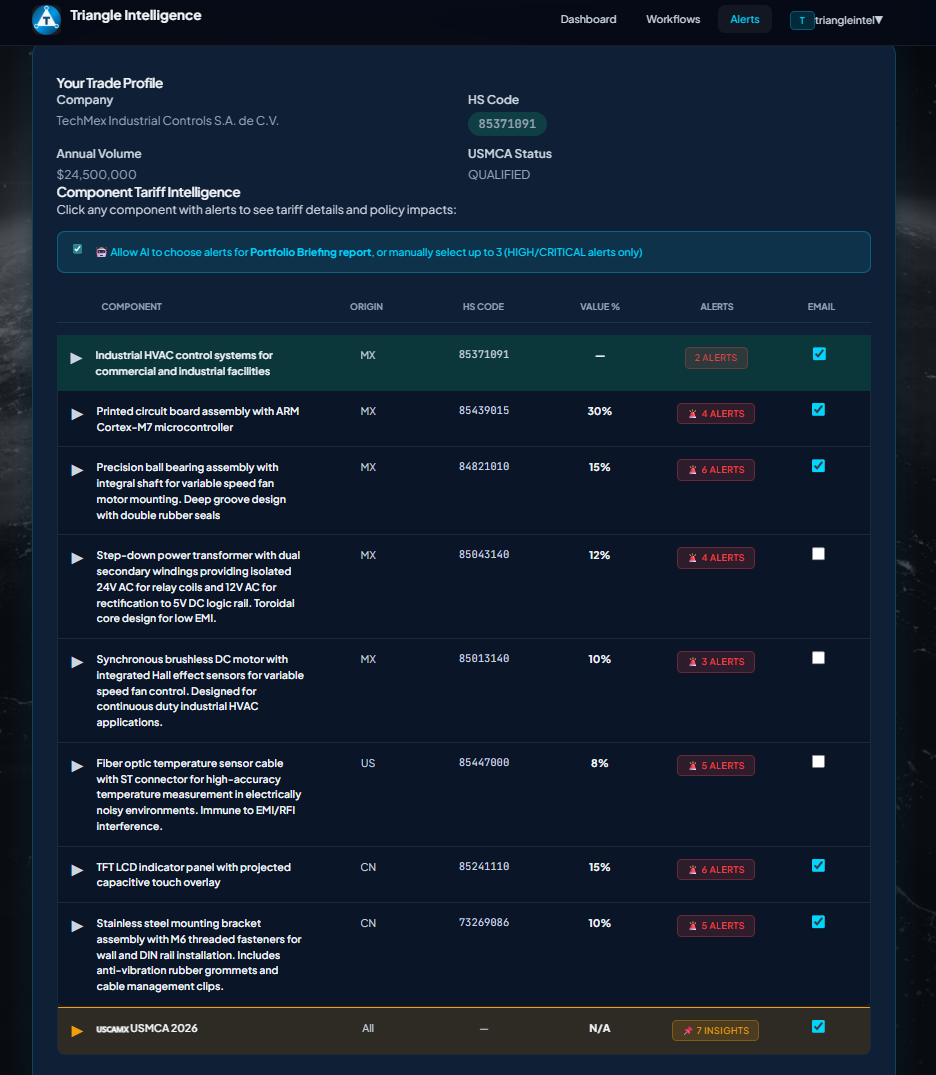

Your Alert Dashboard

One place to see all alerts, reports, and policy updates.

Active Alerts

- ✓ Color-coded by severity (Critical/High/Medium/Low)

- ✓ Status tracking (New/Updated/Resolved)

- ✓ Organized by component

- ✓ Click to expand for full details

Report Library

- ✓ Portfolio briefings for each policy change

- ✓ Historical analysis archive

- ✓ Download as PDF for broker review

- ✓ Share with your team or consultants

Weekly Email Digest

We bundle all changes into one weekly email. No alert fatigue.

What You Get Every Week (Monday 8 AM UTC)

✓ Summary of all tariff changes detected in the last 7 days

✓ Which of YOUR components are affected

✓ Rate impact (old rate → new rate)

✓ Confidence level on each detected change

✓ Immediate action steps (if any)

✓ Link to full portfolio briefing report

No Alert Spam:

We don't send multiple emails per week. We bundle everything into ONE weekly digest. If nothing changed that affects you? No email.

Real Example: Section 301 Alert

What Happened

USTR announced 25% → 30% tariff increase on Chinese semiconductors (HS 8542.31.00), effective in 30 days.

What We Did

✓ Sent alert to users with this HS code from China

✓ Generated portfolio briefing with Mexico supplier ROI

✓ Showed 18-month payback timeline for nearshoring

✓ Provided 3-phase migration plan with supplier contacts

User had 30 days to act - not 30 days to research and THEN act. They migrated 2 components to Mexico before the tariff hit.

How Triangle Works

Think of us like TurboTax for trade compliance. You enter your product and supplier information, our AI calculates USMCA qualification and generates your certificates. You review, verify, and file.

You Provide

Product details, component origins, supplier information

We Calculate

HS codes, RVC percentages, tariff rates, certificate documents

You Verify

Review results, consult your broker if needed, file with confidence

All calculations are informational. Verify with official sources or licensed customs brokers before submission to authorities.